‘One day, mankind will walk in the skies without a plane, go to the planets, and perhaps send us news from the moon.’

Mustafa Kemal Atatürk (Eskişehir Aircraft Regiment in 1936)

Introduction

Space launches drive the space race through their technological brilliance, scientific development, competitive advantage, and national prestige. Space Launches are the key enabler – and limiting factor – to the current commercial space enterprise. While of course a statement of technological prowess and national prestige, a robust domestic space launch capability should be understood first and foremost as a strategic imperative.

Rocket engines are essential to every space launch, making their availability a crucial element in sustaining any nation’s ambitions in space. Unfortunately, most NATO countries are strategically vulnerable when it comes to the availability of rocket engines. It is therefore crucial to diversify supply chains, build domestic capabilities, and promote international cooperation to guarantee the resilience and autonomy of space programmes essential for both military and civilian applications.

This article will provide a brief history of the Russian RD-180 engine and the consequences of reliance on this engine, a description of NATO nations‘ current launch capabilities, an analysis of commercial, civilian, and governmental launch needs, and finally, recommendations for NATO nations such as opportunities to develop domestic and collective rocket engines.

Problem: Dependence on the RD-180

Russia first developed the RD-180 rocket engine in the 1990s for use in the first stage of the American Atlas V launch vehicle, which is currently operated by United Launch Alliance (ULA), a joint venture between Lockheed Martin and Boeing. Since then, NATO nations, including the United States, have depended on the RD-180 to launch military and intelligence satellites into space. The RD-180 was the first Russian-built engine launched from outside of Russia. With a notable thrust-to-weight ratio, the RD-180 can propel large payloads into space with considerable power. It has a dual nozzle and dual combustion chamber design that can be throttled for variable thrust levels during flight. The engine produces up to 860,000 lbs of thrust at sea level.1 The US has received 122 RD-180 engines from Russia, 104 of which have been employed by the US military for several national defence missions. The RD-180 has been essential to the success of the Atlas V, one of the most dependable and economical launch vehicles currently on the market.

Regardless of the political tensions between the two nations, the Russian and American space industries worked together to develop the RD-180 engine. The decision to use Russian engines was not only technical, but it also had to do with US government policy following the fall of the Soviet Union to cooperate on broader non-proliferation initiatives by peacefully engaging with the Russian aerospace industrial base. Despite the Atlas V’s perfect launch rate, Russia’s invasion of Crimea in 2014 served as a wake-up call for the US to find an alternative. Following ongoing tensions between Russia and Western nations, the US Congress expressed concern and directed the establishment of a domestic launch capability, whereas other space-faring NATO nations merely expressed concern about the reliance on Russian rocket engines but did not propose or direct divestment from Russian engine technology.2

In response to the US congressional mandate, Blue Origin began to design a new engine to replace the RD-180, the Blue Engine-4 (BE-4). BE-4 engines will power the first stage of ULA’s new rocket, Vulcan, which was designed to replace the Atlas V. The BE-4 is projected to be a qualified reusable medium-to-heavy lift booster for all orbital planes; however, the BE-4 is currently undergoing full-scale engine development testing and recently experienced a catastrophic test failure raising concerns for its future-ready date.3 ULA is aiming to launch 25 missions in 2025, of which half will be government missions and half for commercial customers.4 SpaceX is also competing in the medium-to-heavy lift market, having designed and recently demonstrated their reusable Merlin engine. Reusability is fast becoming the desired future for the launch vehicle industry as it can significantly reduce costs in the long run. These programmes aimed to ensure the US would have greater control over its access to space and less reliance on vital components sourced from geopolitical adversaries.

Following its full-scale invasion of Ukraine in February 2022, Russia formally announced that it would no longer sell or support the RD-180 to any country that aids Ukraine. This decision validated the US concerns from 2014 and emphasized the need for the US space industry to establish lasting independent launch programmes. In contrast to the US approach, the absence of a comparable decision by other NATO spacefaring countries has proven to be a strategic vulnerability. Even with efforts to lessen reliance on them, Russian rocket engines have been crucial for NATO members for 30 years. The Alliance’s reliance on these engines not only harms domestic supply chains for rocket engines, which has led to delays in space launches for NATO nations, it is also a strategic vulnerability to the Alliance’s long term security interests in space.

Russia’s decision on RD-180 was not the only example of how, since the start of the invasion of Ukraine, the decades-long space cooperation between Russia and the West has deteriorated significantly. Scheduled for liftoff on 5 March 2022, the Soyuz rocket loaded with 36 OneWeb satellites became the first space launch cancelled because of the Russian war against Ukraine.5Eutelsat OneWeb is a subsidiary of Eutelsat Group, formed through the combination of Eutelsat (France) and OneWeb (UK), to build a constellation of 648 broadband satellites. Russia’s decision to stymie one of its space agency’s most important commercial clients was the clearest example yet of how the conflict in Ukraine was spilling over into space. The move further isolated Russia’s space agency from its Western space partners and severely restricted Russia’s private space activities.

Until an alternative is found, Alliance members will have to limit the scope or frequency of their space missions and look to the US industry to fill the newly exposed gap. However, the US alone is insufficient to meet the launch needs of the entire Alliance, considering the average current and future launch rates. The impact of Russian engine elimination on NATO countries’ access to space will be determined by how they respond to these challenges. NATO nations face a decision point: either maintain the status quo and endure a vulnerability or follow the US blueprint and create resilience for future space programmes. If the latter is chosen, there may be short-term impacts due to the long development cycle of creating a new launch programme, but it is an opportunity for NATO nations to invest in their own space technology and reduce their reliance on foreign engines in the long term.

Current Launch Capabilities within the NATO Nations

NATO does not own space assets directly. Nonetheless, it plays a significant role in coordinating and ensuring the security of space activities for its member states. Several NATO members maintain their own space programmes and are actively involved in launching satellites for a range of purposes, including military, governmental, and civilian applications. These space programmes are critical for national security, communication, scientific research, and more. Few NATO members have independent space launch programmes, but the Alliance’s framework for collective security, information exchange, and cooperation binds them all together.

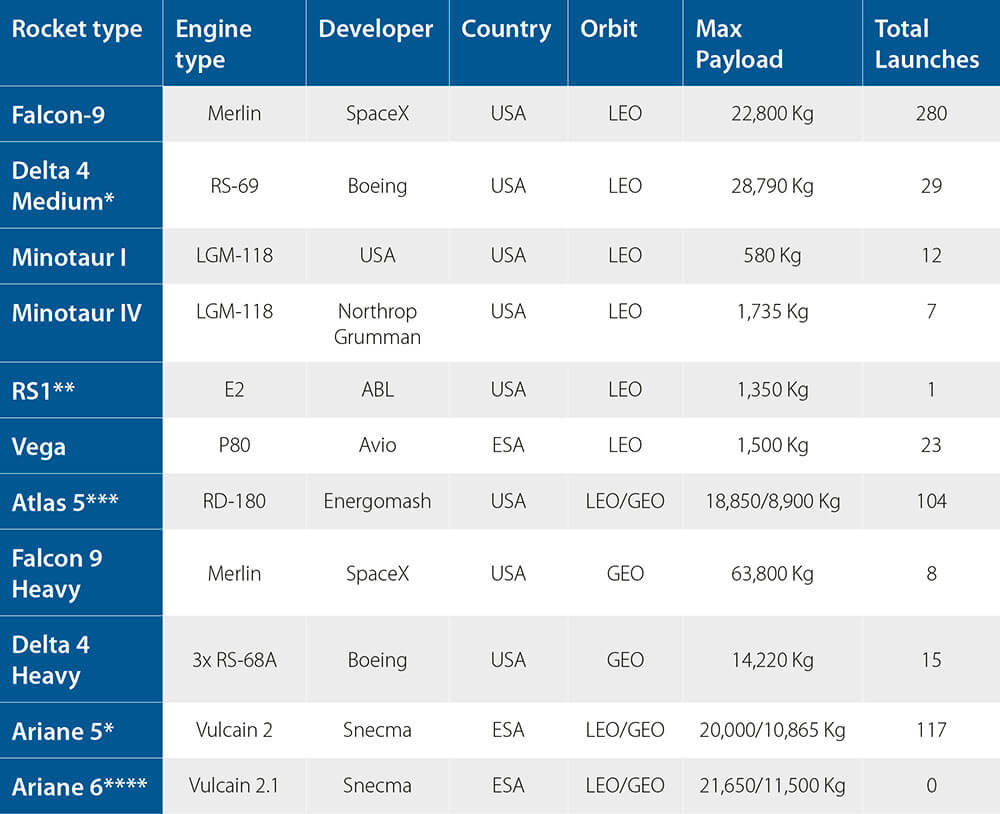

With considerable space-based capabilities, the US is the most active NATO member in terms of launch capability, as depicted in Table 1.1. Aside from US providers, the Ariane rocket family, operated by the European Space Agency (ESA), is used to launch both commercial and governmental satellites. The final Ariane 5 launch occurred on 6 July 2023 after 27 years of service. Ariane 6 initially planned to begin flying in 2021 to replace the Ariane 5. Nonetheless, the programme has experienced difficulties, and its first launch is now expected in June 2024.

An analysis of Table 1.1 reveals alarming trends that deserve attention.

- The US currently provides the only option within NATO to place a space asset into Geostationary Orbit (GEO).

- The only proven launch-capable asset available from the rest of NATO is the Vega. The Vega is operational, but its limited boost capacity restricts the types of missions the engine can support.

- The stockpile of RD-180 engines is dwindling (only 18 remain for Atlas 5 missions), limiting the number of launches that can reach GEO.

Table 1.1: Current Launch Capabilities of NATO nations.

* Retired.

** Not fully operational yet.

*** Uses previously purchased engines prior to the Russian response to sanctions.

**** In development status (not operational).

© JAPCC

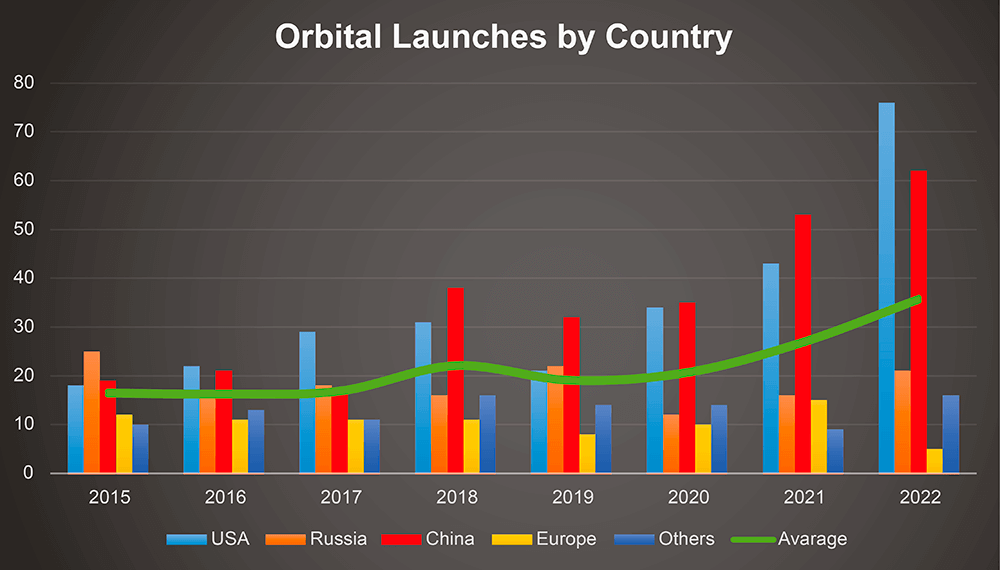

Two noteworthy advancements are the expansion of satellite communication systems and the employment of remote-sensing satellites for both military and non-military purposes. According to the Index of Objects Launched into Outer Space maintained by the United Nations Office for Outer Space Affairs (UNOOSA), there are 12,121 individual satellites orbiting the Earth as of 15 November 2023.6 Because of technological developments and rising demand for space-based services, nations have increased space launches in recent years as seen in Figure 1. Figure 1 shows a marketed launch rate increase due to the commercial expansion in the space domain.

Civilian vs. Government Breakdown

The introduction of the Starlink and OneWeb mega constellations has significantly impacted the market for government payload launches. Armed forces or international space agencies normally carry out government space programmes, but the growth of private space enterprises has increased competition, resulting in lowered prices. While government organizations continue to fund long-term space exploration efforts and national security-related missions, commercial companies are pushing to be global providers of space data, products, and services for the world’s citizens. With the rapid expansion of commercial enterprises like SpaceX and OneWeb, the competition for engines that were once exclusively accessible to governments has intensified. This surge in demand for engines in the LEO sector has created a highly competitive environment.

Figure 1: Orbital launches by country since 2015.9 © JAPCC

Expanding the world’s space industry is one of the most notable reasons for the exponentially rising demand for space launches. Launch costs are forecasted to decrease, which will trigger more companies to access space, further exacerbating the availability of launch engines. Satellite manufacturers, space launch service providers, and technology innovators stand to gain as they scale up to meet the growing demand. Commercial launch service providers such as SpaceX, Rocket Lab, Blue Origin, and ULA are developing rocket engines to improve performance, dependability, and reusability. Companies like SpaceX and Rocket Lab have been able to cut costs. SpaceX has perfected its design by using reusable engines such as the Merlin and the new Raptor. Likewise, Rocket Lab is developing the heavy lift Neutron engine, designed for mega constellation deployment, deep space missions, and human spaceflight with a fully reusable first stage and fairing.7

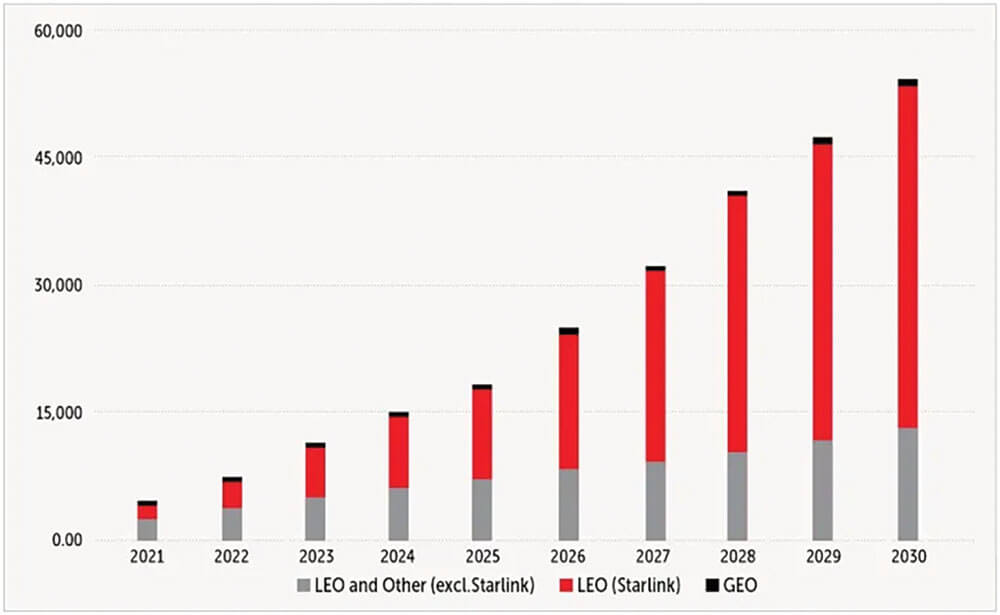

The average rate of objects launched into space annually between 1957 and 2013 was around 118, which helps provide context for the average rate of 936 for the last ten years.8 The latest advancements in small satellite technology bring an unprecedented new volume of spacecraft into orbit; the largest expansion are systems operating in Low Earth Orbit (LEO). In 2021, there were approximately 4,400 satellites in various orbital bins – including LEO, Medium Earth Orbit (MEO), and GEO. As depicted in Figure 2, the projected increase of satellites in orbit sheds light on the urgent need for expanded launch capabilities.

Figure 2: Falling launch costs have contributed to a surge in customers, increasing competition for launch slots.10 © Robin McDowall, SpaceNews

SpaceX launched its first round of 60 Starlink satellites into LEO in May 2019 on one of SpaceX’s Falcon 9 rockets. Today, the company has over 5,000 satellites in orbit, with aspirations to have a constellation of 42,000 within the next ten years. The impact of SpaceX (Starlink) is clear as seen in Figure 2, but we must consider it an outlier as SpaceX controls all the phases of production unlike any other company. NATO nations must instead focus on the projected 200% growth only seven years.. As SpaceX prioritizes their own engines to deploy Starlink, the launch industry must find a way to pay the 200% growth bill now to meet the need by 2030.

Recommendations: Domestic Launch Investments and Collective Opportunities

Considering the arguments presented above, the suggested recommendations to meet the NATO’s Strategy for Heavy Space Lift are listed below.

- Rocket engine R&D should be a collective effort to encourage cost reductions and to expand launch technology.

- NATO nations should prioritize their launch investments in rocket engine production.

- Establish a set of guideline standards for engine design to improve opportunities for interoperability. This establishes a uniformity that can lead to efficiencies in other elements of the launch process, such as launch pads and fuelling systems.

- Nations must focus on payloads designed for LEO until launch programmes that deploy to GEO are widely available.

- All future space launch programmes should consider reusability as the most reasonable path for cost-effectiveness and debris mitigation.

- NATO nations must not fall back on utilizing Russian engines once the war of aggression has concluded and must avoid future dependencies with nations that hold interests counter to NATO’s.

Conclusion

Russia’s invasion of Ukraine and subsequent removal of RD-180 engines from the international market has proven to be an epiphany for many NATO nations with aspirations to access space. In the short term, the US decision to diversify launch capabilities has enabled the NATO Alliance to weather the storm; however, due to the expected increase in launch need, the US will no longer be able to be the sole provider of the Alliance’s access to space. Rocket engines are essential to access space, and the availability of rocket engines is a crucial element in sustaining any nation’s level of ambition in the space domain. Adopting these recommendations will enable the Alliance to be resilient to future disruptions to the launch sector while transforming the Alliance as a global leader in the space domain. Failure to adapt to the tidal wave of launch needs will put the Alliance’s leadership position in the space domain at risk, and NATO nations may cede the initiative in space to adversaries.